Updated By: LatestGKGS Desk

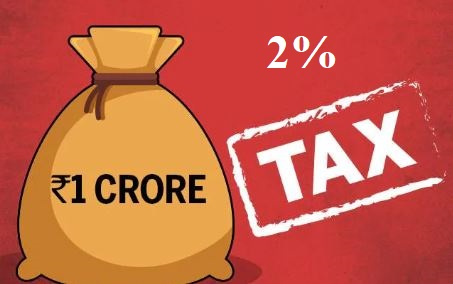

Union Budget 2019: Rs 1 crore or above cash withdrawal to levy 2% TDS

Union Budget 2019: Rs 1 crore or above cash withdrawal to levy 2% TDS

Finance Minister Nirmala Sitharaman presented her first Union Budget 2019-20 in Lok Sabha, on 5th July 2019.

Union Budget 2019 initiated to levy tax deduction at source (TDS) of 2 percent on cash withdrawal of more than Rs 1 crore from a bank account in one financial year to discourage business payments in cash.

According to the new rule, to withdraw more than 1 crore rupees annually, 2 lakh rupees will be deducted in tax. This is being done because the trend of increasing business payments in cash was increasing rapidly.

The central government's decision will reduce the cash transactions of business payments.

People will move towards DD, check or online payments. This will ease the rigors that occur during business payments.

The central government hopes to reduce economic corruption by this move. The easiest of financial transactions is the best thing for digital payment systems.

One should do not need to take in cash in hand, plastic card, bank or ATM line. Especially when you're on a journey, this is a safe and easy option to spend.