Updated By: LatestGKGS Desk

Bad Loans makes PSBs to pay interest on additional tier bonds AT1

Four Public Sector Banks to pay interest on AT1 bonds, issued at the time of financial crisis

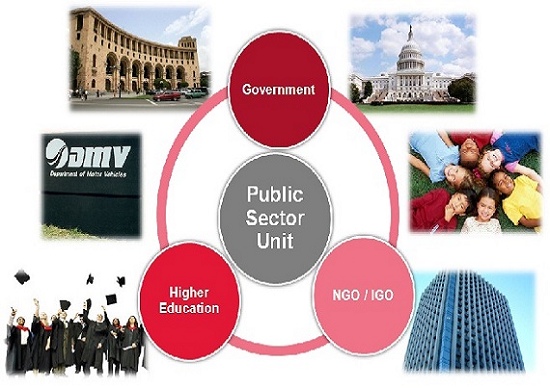

Public Sector Banks expected to pay interest on Addition Tier bonds AT1 issued under Basel III capital regulations, as they conveyed of suffering from heavy losses due to course of bad loans.

AT1 is the special bond which is issued at the time of financial crisis and can be converted from debt to equity.

AT1 bonds also known as Contingent Convertible Capital Instruments (CoCos)

AT1 bond also known as Contingent Convertible Capital Instruments (CoCos) is the combination of debt and equity and are the riskiest debt issued by the banks.

Public Sector Banks are finding it difficult to pay the interest as they have less profits and more losses which is creating an obstacle to pay.

The Government has also promised for Capital support to public Sector Banks on the coupon of AT1 bonds and will be provided to the current year’s profit.