Updated By: LatestGKGS Desk

Farmers Eligibility for PM Kisan Samman Nidhi 2021 Onwards

Farmers Eligibility Criteria for Prime Minister Kisan Samman Nidhi 2021 Onwards Updated

If a farmer does farming but that field is not in his name but in the name of his father or grandfather, then he will not get the benefit of PM Kisan Samman Nidhi Rs 6000 annually. That land should be in the name of the farmer.

If someone has agricultural land but there is non-agriculture activity on it, even then the benefit will not be available.

Even if the cultivable land is not being cultivated, the benefit will not be available.

If a farmer takes land from another farmer and does farming on rent, even then the person cultivating on that rent will not get the benefit of the scheme.

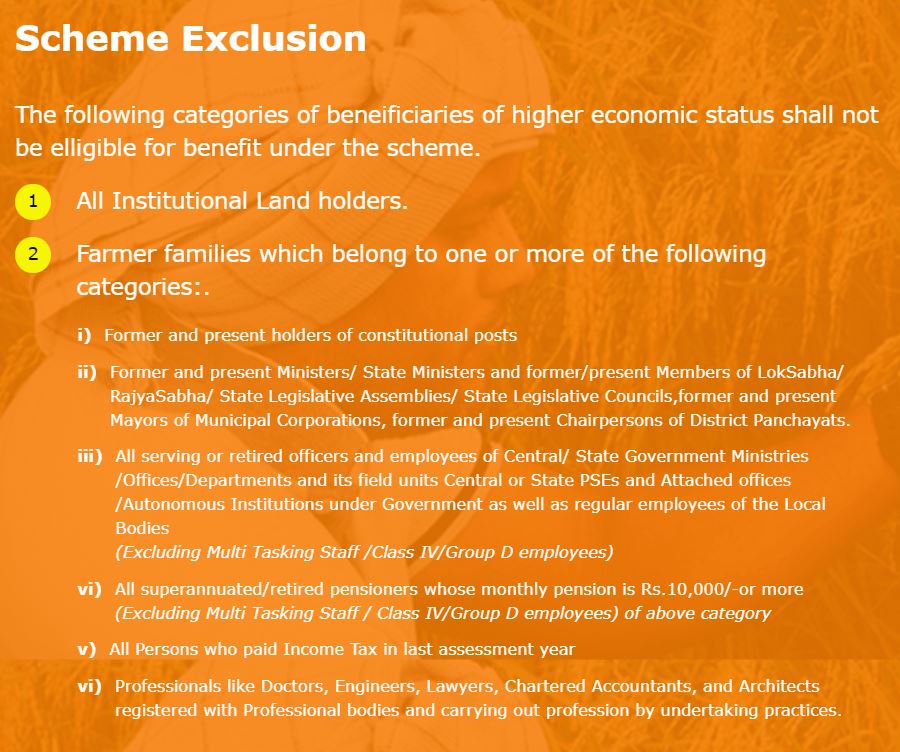

Not all institutional landholders will come under the purview of this scheme.

If any farmer or his family has or was in any constitutional post, then that farmer's family will not get the benefit.

State/Central Government employees or retired employees, retired or serving employees of PSUs/PSEs, serving or retired officers and employees of Government Autonomous Bodies, employees of local bodies cannot avail the benefit of the scheme.

Former or serving Minister/Minister of State, Mayor or District Panchayat President, MLA, MLC, Lok Sabha, and Rajya Sabha MP are not eligible.

Professionals like doctors, engineers, CAs, architects, and lawyers will also not get the benefit of the scheme, even if they do agriculture.

Retired pensioners getting a monthly pension of more than Rs 10,000 will not get this benefit.

If a farmer or any of his family has paid income tax in the last assessment year, then that farmer's family is also excluded from the purview of the scheme.