Updated By: LatestGKGS Desk

GST rate structure for petroleum and oil sector

GST (Goods and Service Tax) rate structure for petroleum and oil sector

To reduce the cascading of taxes arising on account of non-inclusion of petrol, diesel, ATF, natural gas and crude oil in GST.

Beside this, to incentivize investment in the Exploration and Production (F&P) sector and downstream sector, the GST Council in its 22 nd meeting held on 6th of October 2017.

The meeting has made the following recommendations for GST rate structure for specified Goods and Services.

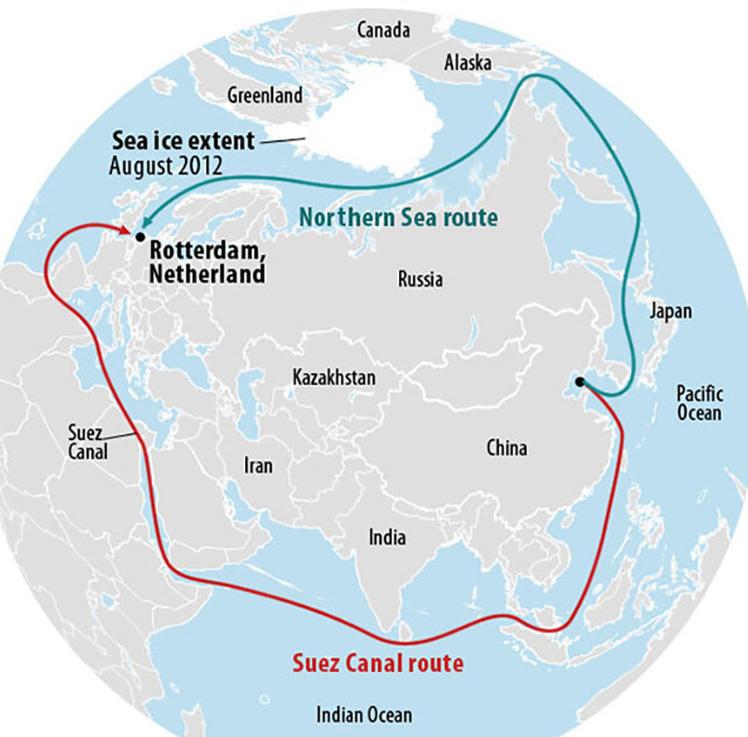

Offshore works contract services and associated services relating to oil and hag exploration and production in the offshore areas beyond 12 nautical miles shall attract GST of 12 %.

Transportation of natural gas through the pipeline will attract GST of 5 % without input tax credits (ITC) or 12 % with full ITC.

Import of rigs and ancillary goods imported under the lease will be exempted from IGST, subject to payment of appropriate IGST on the supply or import of such lease service and fulfillment of other specified conditions.

Further, GST rate on bunker fuel is being reduced to 5 % both for foreign going vessels and coastal vessels