Updated By: LatestGKGS Desk

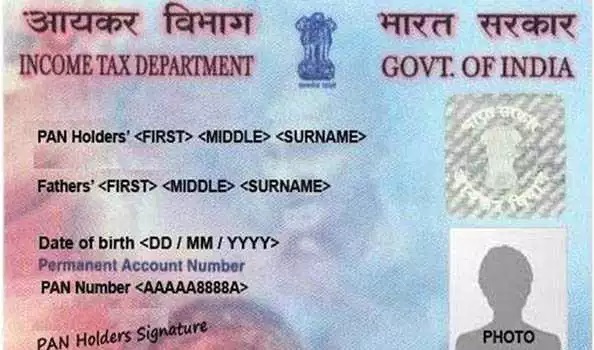

Permanent Account Number PAN Card Features, Purpose, Specification

Permanent Account Number 'PAN' Card- About, Features, Purpose

Permanent Account Number (PAN) is a ten-digit alphanumeric number, issued by the Income Tax Department of India in form of a laminated tamper-proof card.

PAN was introduced to facilitates linking of various documents, including payment of taxes, assessment, tax demand, tax arrears etc. relating to an assesses for a widening of tax base and detecting and combating tax evasion.

PAN main purpose is to facilitate easy retrieval of information and facilitate matching of information relating to investment, rising of loans and other business activities of taxpayers collected through various sources, both internal as well as external.

PAN is unique to individual or entity and it is valid across India.

PAN once allotted to individual or entity, it is unaffected by the change of name, address within or across states in India or other factors. It enables the department to link all transactions of a person with IT Department.