Updated By: LatestGKGS Desk

Banking Sector: Negotiables Instrument and various laws

Bank: The negotiable instrument described by various laws and simple definition

A negotiable instrument is an order in writing from one person to another with the promise to pay money on demand. There is the definition of the Negotiable instrument described by various laws one simple definition we can take it :

An unconditional order in writing addressed by one person to another, signed by the person giving it requiring the person to whom it is addressed to pay on demand, or at a fixed or determinable future time, a sum of certain in money to or to the order of a specified person or to a bearer.

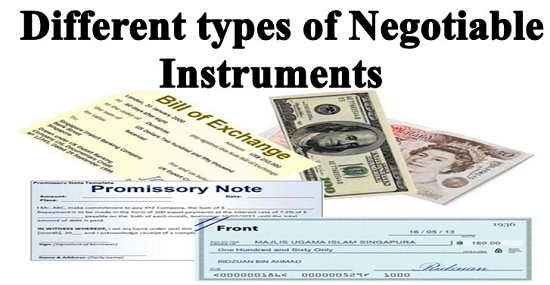

The most common negotiable instrument in India is Cheque it also serves as draft payable by the payer's financial institution upon receipt in the exact amount specified.

Money order is also one of common instrument used but may or may not issued by payer, Traveller cheque, etc are one of the most common instruments which are widely used.

Bill of Exchange, Promissory note, Draft and certificate of deposit are considered as a noncommon instrument.