Updated By: LatestGKGS Desk

Monetary Policy and Fiscal Policy, Management Of The Country's Economy

Monetary Policy and Fiscal Policy, Management Of The Country's Economy And Economic Growth

Monetary Policy is the process by which monetary authority (an authority that controls all matters related to money) of a country, generally a central bank controls the supply of money in the economy by exercising its control over interest rates in order to maintain price stability, reduce inflation and get high economic growth.

A sound monetary policy ensures that there is sufficient tokens/authority to carry out its transactions in different areas of the country. It provides the basis of fiscal policy and the fiscal policy influences the monetary policy and gives it a direction to proceed in.

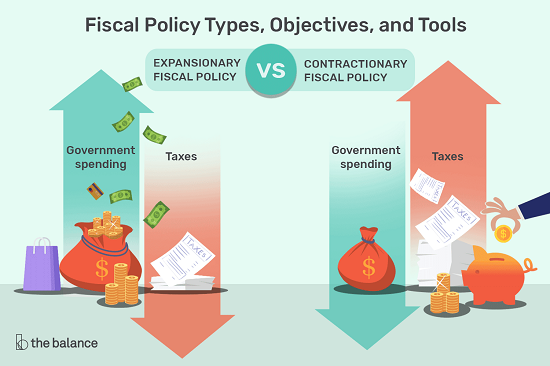

It is the policy taken out by the government regarding the use of revenue (taxation) and expenditure among different sectors to influence the country's economy and achieve welfare objectives like economic development and development full employment, price stability, and balanced demand and supply system within and outside. The fiscal policy is a statement of the same.

And the most visible tool of the fiscal policy in action is 'Budget'. Monetary policy and Fiscal Policy are complementary and equally necessary in the management of the country's economy as is already explained above under Monetary Policy.