Updated By: LatestGKGS Desk

How to file Income Tax Return (ITR) online: Steps to follow

How to file Income Tax Return (ITR) online: Steps to follow

Indian citizens who are earning an annual income up to 50 lakh will have to fill ITR Form-1.

Also, if the taxpayer has income on interest paid on salary or pension, a house or shop, then he has to fill this form.

Documents Required

Taxpayers must have the following documents for filing ITR.

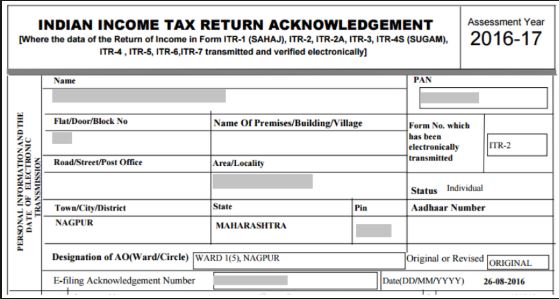

1.Pan Card

2. Aadhaar Card

3. Form 16 issued by the company

4. Form 26S

Steps To File ITR

1. Visit this website: www.incometaxindiaefiling.gov.in

2. To file an e-file, the taxpayer must have a PAN number User ID and password.

3. The taxpayer must log in at incometaxindiaefiling.gov.in using the username and password.

4. After this, click on the Income Tax Returns page.

5. After clicking, you must specify your assessment year, ITR form and submission mode.

6. After that click on the 'Prepare and submit online' option.

7. On this page, you will need to fill in your information and click on the E-Verify option.

8. After this, you have to give all your income information on the next page.

After this, you will know about the total income tax payable.

After this, you will have to pay your total income tax payable with NetBanking or Debit Card.

Before that, you will also get a preview of your returns. If you are satisfied with all the information, then you can file returns.