Updated By: LatestGKGS Desk

Income Tax Returns 'ITR' Filing Benefits

Income Tax Returns 'ITR' Filing Benefits

When the income of the entire financial year does not fall within the tax, then what is the benefit of filing an Income Tax Return (ITR).

Actually, the Income Tax Act does not compel the ITR to be filled in the amount of tax exemption.

According to income tax law, if you are under 60 years old and the annual income is not more than 2.5 lakh rupees then you have no obligation to fill the ITR.

Similarly, an annual income of more than Rs 60 lakhs and people below 80 years of age and Rs 3 lakh per annum for a person above 80 years of age, is not a legal obligation to fill ITR.

Let's Know what are the Benefits

1. Easy Loan Approval

Filing the ITR will help individuals, when they have to apply for any vehicle loan (2-wheeler or 4-wheeler), House Loan, etc. All major banks can ask for a copy of tax returns

2. Claim Tax Refund

If you have a refund due from the Income Tax Department, you will have to file an Income Tax Return to claim the refund.

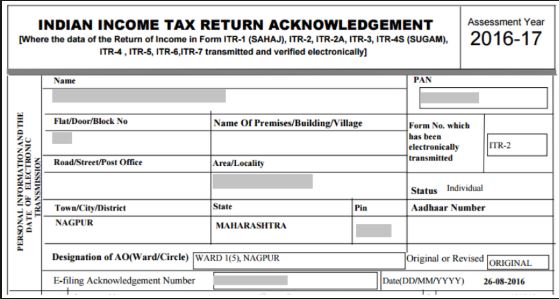

3. Income & Address Proof

Income Tax Return can be used as proof of your Income and Address.

4. Quick Visa Processing

Most embassies & consulates require you to furnish copies of your tax returns for the past couple of years at the time of the visa application.

5. Carry Forward Your Losses

If you file the return within due date, you will be able to carry forward losses to subsequent years, which can be used to set off against income of subsequent years.

6. Avoid Penalty

If you are required to file your Tax returns but didn’t, then the tax officer deserves the right to impose a penalty of up to Rs.5,000.