Updated By: LatestGKGS Desk

Indian Economy 2017 major steps, features, GST, Recapitalisation and NPAs

GST, Recapitalisation and NPA decision year review for Indian Economy-2017

The year 2017, started with the effects of Demonetization in 2016, brought about many changes in the Indian economy.

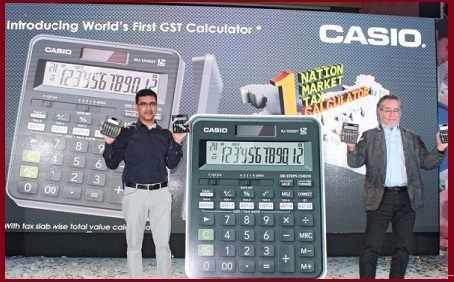

Goods and Services Tax (GST) is an indirect tax which got applicable throughout the country from 1 July 2017. The single GST exterminated several indirect taxes levied by the central and state governments, with a unified tax system.

GST reasonably reformed the country's 2 trillion dollar economy. Under GST, goods & services are been taxed at 0%, 5%, 12%, 18% and 28% excluding, Petrol, Diesel and Alcohol as a part of GST.

On 24 October 2017, Union Finance Minister, Arun Jaitley announced an allocation of Rs 2.11 lakh crore over the two years for the recapitalisation of public sector banks (PSBs).

The proposal is meant to help banks with high, Non-Performing Assets (NPAs) and to make appropriate arrangements against bad loans and revive lending, which, in turn, may help & support a recovery in the slowing economy and private investments.