Updated By: LatestGKGS Desk

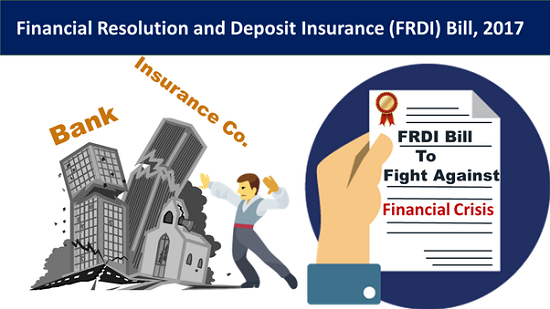

Bank and Insurance: Financial Resolution and Deposit Insurance (FRDI) Bill 2017

Bank And Insurance: Financial Resolution and Deposit Insurance(FRDI) Bill 2017 and The new bill aims for an orderly winding up of a financial institution

It talks about setting up a Resolution Corporation (RC) that will identify early warning signs of distress at financial institutions, including banks, non-banking financial companies, insurance companies, stock exchanges, etc.

If a bank, a Non Banking Finance Company (NBFC), an insurance company, a pension fund or a mutual fund run by an asset management company, fails, a quick solution is available to either sell that firm, merge it with another firm, or close it down, with the least disruption to the system, to the economy, and to investors and other stakeholders.

This was recommended by the Financial Sector Legislative Reforms Commission (FSLRC) headed by Justice B N Srikrishna.

Bailouts incentivized bank management to take risky bets — called “moral hazard” by economists — led governments to seek other solutions.

"Bail-in" allows resolution agencies to override the rights of the shareholders of the firm — this could mean writing down of a company’s equity and debt to absorb losses, or converting debt into equity. This could also mean overriding requirements such as approvals by shareholders and disposing of the firms' assets.