Updated By: LatestGKGS Desk

Bond, Bond Yield, & Bond Yield Curve:Understanding the Definition & Important Details

What is the Bond and Bond Yield Curve terminology in Economy?

As talk of a recession gets louder globally, Bond yields curve have featured in news reports both globally and within India in recent months as it most accurately reflects what investors think about current and future economic growth prospects.

Bond:

- A Bond is an instrument to borrow money. A bond could be floated/issued by a country's government or by a company to raise funds.

- Since government bonds (referred to as G-secs in India) come with the sovereign's guarantee, they are considered one of the safest investments. As a result, they also give the lowest returns on investment (or yields).

- Investments in corporate bonds tend to be riskier because the chances of failure (and, therefore, the chances of the company not paying the loan) are higher.

Bond Yield:

- The yield of a bond is the effective rate of returns that it earns.

- But the rate of return is not fixed. It changes with the price of the bond.

Bond Yield Curve:

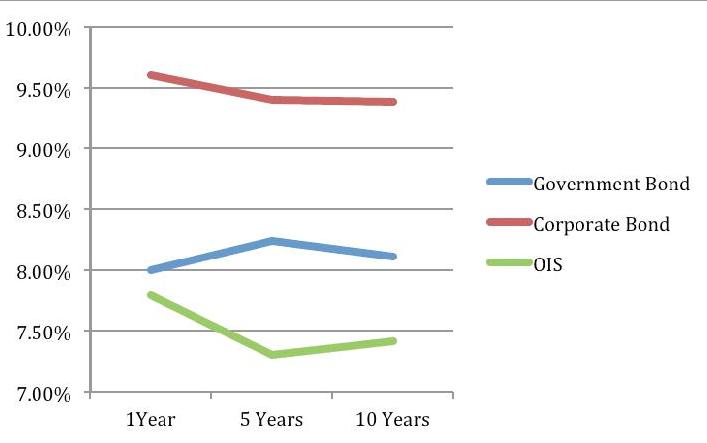

- A yield curve is a graphical representation of yields for bonds (with an equal credit rating) over different time horizons.

- If bond investors expect the economy to grow normally, then they would expect to be rewarded more (get more yield) when they lend for a longer period. This gives rise to a normal-upward sloping-yeild curve.

- The steepness of this yield curve is determined by how fast an economy is expected to grow. When the economy is expected to grow only marginally, the yield curve is 'flat'.

- Yield invesion happens when the yield on a longer tenure bond becomes less than the yield for a shorter tenure bond. A yield inversion typically portends a recession. An inverted yield curve shows that investors expect the future growth to fall sharply.