Updated By: LatestGKGS Desk

PAN Latest Updates: Father's name in Pan applications is not compulsory

PAN Latest Updates: Father's name in Pan applications is not compulsory- Details, Highlights

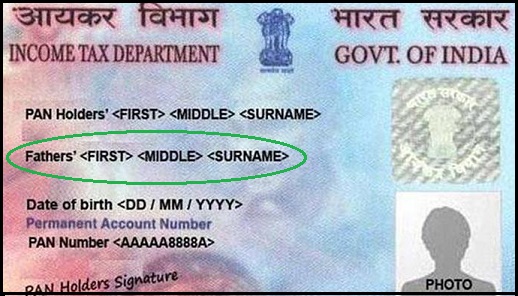

India's Income tax department on 20th November 2018, announced that father's name in (Permanent Account Number) PAN application forms will not be compulsory in cases where the mother of the applicant is a single parent.

The Central Board of Direct Taxes (CBDT) in a notification, notified this new income tax rules and announced the application forms would give an option to the applicant as to whether the mother is a single parent and the applicant wishes to furnish the name of the mother only.

Till date, mentioning father's name was compulsory for the allotment of Permanent Account Number (PAN).

Other Notifications

The CBDT notification has also made it necessary for entities that have made financial transactions worth Rs 2.5 lakh or more in a financial year to apply for a PAN card. The application has to be filed on or before 31st May of the assessment year for which such income is assessable.