Updated By: LatestGKGS Desk

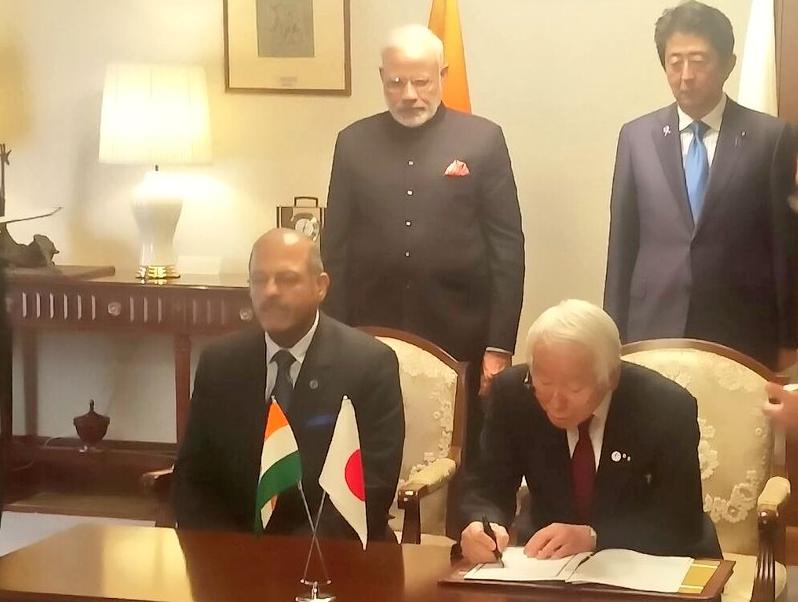

India Japan Double Taxation Agreement for bilateral tax in force

The agreement between India and Japan was amended for bilateral tax has come into force from 29th October 2016

The amended bilateral tax agreement strengthen the exchange of information and to reduce tax elusion.

The Government of India and Government of Japan have signed agreement to avoid double taxation and prevention of fiscal invasion with respect to taxes on income.

Article 26 and Article 11 also amended

Article 26 of the convention states that the information received under Double Tax Avoidance Agreement would be kept secret and will be disclosed only to the tax officials.

Article 11 has also been amended containing the provisions of taxation.

Both the government has amended the 27 year old agreement for Double Taxation Avoidance Agreement in 2015.

This will benefit India for the collection of taxes and will help in reducing Tax avoidance.