Updated By: LatestGKGS Desk

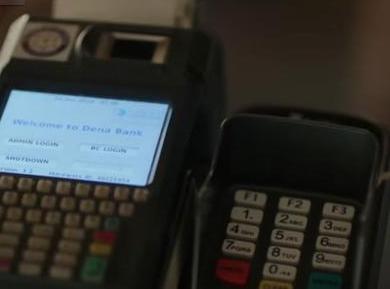

Note Ban: Steps and procedure to use Micro ATM to withdraw cash

Government's new initiative to withdraw the money from micro ATM, steps and procedures

After PM Narendra Modi’s decision to ban 500 and 1000 denomination note, Micro ATMs would help the people to withdraw the amount.

Through Micro ATM, around 70,000 transactions are conducted per week.

Micro ATM is safe and secure and can be easily used by the account holder

To withdraw the amount from Micro ATM, swipe Debit or Credit card and put a thumb impression on the micro ATM machine.

Then enter the pin code of your Debit or Credit card and enter the amount to withdraw.

Advantage of Micro ATM is that due to thumb impression, any other person cannot withdraw the amount from your Bank account.

Bank account holders would also be provided a receipt and accountholders can also update their passbook for withdrawing through micro ATM.